News

How can a MFI manage to have a commercial status and still target “vulnerable” people as a core client group?

When loans are extended to “vulnerable” people, too many of them are left overindebted – this could lead to a highly risky credit crisis. If microfinance institutions need to develop into fully-fledge...

Published on

Microfinance, an opportunity for socially responsible investment

Microfinance used to be seen as a simple development tool, but now provides private investors with attractive investment opportunities. It creates social benefits by helping to democratize access to f...

Published on

The role of development finance institutions in good governance for microfinance

Development finance institutions, via their involvement in the sector, give microfinance greater access to private financing. They also play a decisive role in the governance of microfinance instituti...

Published on

Striking a balance between affordable rates and satisfactory profitability in microfinance institutions

The interest rates charged by microfinance institutions (MFIs) are calculated on the basis of their financial situations and profitability targets. To make these rates more affordable for their low in...

Published on

Managing the social performance of microfinance institutions

Microfinance is booming. Beyond financial performance, it is essential for the sector not to lose sight of its social objective. The most innovative MFIs are reacting quickly to the first cases of abu...

Published on

Recent developments in the impact and mechanisms of microfinance

Microfinance has aroused widespread enthusiasm over the past 20 years. Its specific credit methodology (group solidarity, small loans, etc…) was thought to solve a number of informational problems on...

Published on

What resources to finance the development of the microfinance sector?

Microfinance is booming and requires considerable additional funds. The equity of microfinance institutions (MFIs) needs to be strengthened; private investors – that invest when certain conditions are...

Published on

Microfinance and non-financial services: an impossible marriage?

Microfinance institutions (MFIs) can - in addition to their classic products - develop non-financial services: vocational training, technical assistance, agricultural or health education. The comparat...

Published on

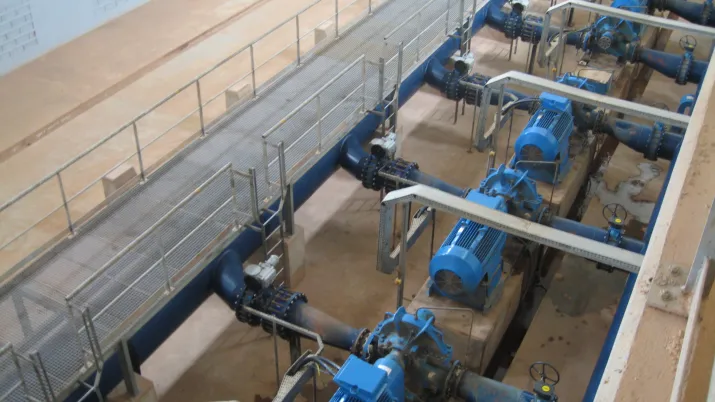

Beyond PPPs: the World Economic Forum Water Initiative, a Multi-stakeholder Approach

The World Economic Forum’s public-private water initiative in South Africa and India showed that “Brokerage Networks”, involving stakeholders across all sectors, proved successful in conceptualising,...

Published on

A New Generation of Public-Private Partnerships for Drinking Water and Sanitation in Developing Countries

There is a gradually rising trend in developing countries towards more professionally managed urban drinking water services as a result of delegation to private companies. The integration of a new gen...

Published on

How to Develop Access to Water for the Most Disadvantaged Populations?

Veolia designs and implements specific programs for access to water, sanitation and electricity services for all. Water tariff policies are core to the success of programs to develop access to essenti...

Published on

The Interest of Multiplayer Dialogue for Public Service Operators

IGD has designed the concept of Quadrilogues – four-party dialogues – based on the observation that the success of public-private partnerships depends on the various stakeholders' capacity to dialogue...

Published on

From PPPs to “4Ps”, Public-Private Partnerships Need Participative management

The various experiences of Public-Private Partnerships (PPPs) in developing countries have underscored the importance of participative management and dialogue among stakeholders. They are indeed prere...

Published on

Can Public-Private Partnerships Benefit Populations Excluded from Water Services?

Although public-private partnerships may have achieved relatively disappointing results in terms of extending access to water for poor populations, the arrival of private operators has nevertheless of...

Published on

What is the Actual Performance of Public-Private Partnerships for Urban Water Utilities in Developing Countrie...

By examining progress achieved and problems encountered by 65 public-private partnerships (PPPs) implemented on different continents, a recent World Bank study is providing some objective facts from a...

Published on

SME access to financing: capacities matter as much as resources

Donors must not simply focus on adopting strategies based on providing financing, they must also focus on demand. One of the reasons why it is difficult for SMEs to access financing is they are unable...

Published on

Private equity investment in sub-saharan african SMEs

SME financing cannot be enhanced simply by scaling up volumes of financing. SMEs need to upgrade so that they can meet the eligibility criteria of bankers and other investors. I&P is aware of the diff...

Published on

The difficulties bank face in financing SMEs in Sub-Saharan Africa

Firms and banks alike would seem to be responsible for the lack of SME financing in SSA: firms because of their shortfalls in meeting the classic requirements of the banking sector and banks because t...

Published on

A perspective on SME Financing in Africa

SMEs may account for the bulk of firms and employment in SSA, yet they contribute very little to GDP. This is partly due to the financing constraints they meet. However, these firms have considerable...

Published on

Financing SMEs in a context of strong information asymmetry

The acuteness of information asymmetries between bankers and entrepreneurs, which cannot be offset by adequate loan securitization, constitutes one of the main stumbling blocks to SME financing in SSA...

Published on