Share the page

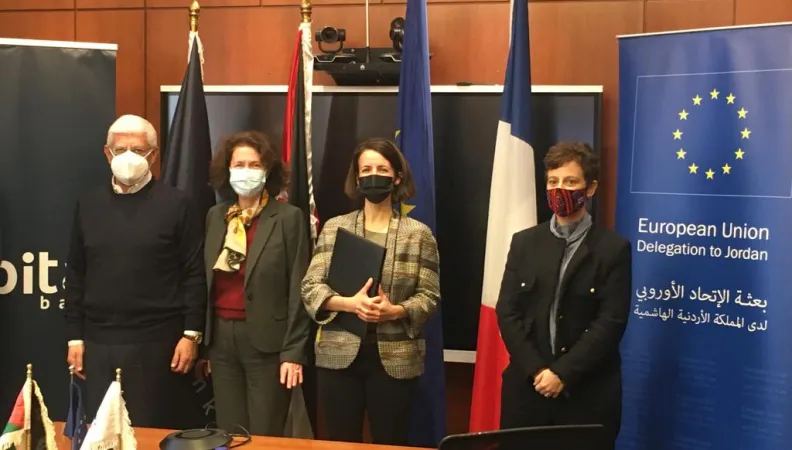

Proparco and the EU partner to support Capital Bank of Jordan through an impact premium

Published on

Following the partnership inked between Capital Bank, Proparco and its German counterpart DEG, a subsidiary of KfW, to support medium-sized enterprises (SMEs) in Jordan, the bank has received an impact premium financed through the EU MENA Facility. Launched in 2021, the Facility benefits from the financial support of the European Union (EU).

In October, Proparco and its German counterpart DEG granted a loan of up to €66 million to support Capital Bank of Jordan to finance and develop its SMEs portfolio with a special focus on selected SME segments: women-led businesses, start-ups, FinTechs, youth-owned businesses and SMEs located outside the capital Amman.

In parallel with the loan, the EU MENA Facility granted an impact premium of up to €850,000 that is conditional to a set of high impact performance criteria. The ultimate aim is to support Capital Bank to further finance very impactful SMEs to achieve economic development in governorates as well as boost job creation across the Kingdom.

The MENA Facility: supporting financial inclusion and the development of SMEs in 7 Mediterranean countries

In 2008, the European Commission launched the Neighborhood Investment Facility (NIF), an innovative financial instrument to support the development of the private sector, particularly for SMEs. The MENA Facility has been operational since 2021 for 6 years and is one of the projects from this “NIF” Initiative implemented by the AFD group. It benefits from EUR 26m of financial support from the EU and aims to support the financial inclusion and financing of SMEs in seven Mediterranean countries: Algeria, Egypt, Jordan, Lebanon, Morocco, Palestine and Tunisia.

The MENA Facility makes it possible to set up guarantees adapted to the risks associated with SME finance, in particular in sectors with a high development impact, and absorb part of the additional cost generated by hedging mechanisms implemented to deploy credit lines in local currency and to fund impact premia in order to incentivize financial institutions. A strong ambition of the Facility is to target high-impact players and sectors, which face difficulties in accessing formal credit, such as women entrepreneurs, start-ups and the renewable energies and agriculture sectors. For example, this objective is achieved through an incentive mechanism, in the form of an “impact premium”, which encourages financial institutions to position themselves more in these high impact segments.

Media contact:

Proparco : Floriane Balac : presse@proparco.fr

EU DELEGATION Communication Officer : Pietro.IENNA@eeas.europa.eu

About Proparco

Proparco is the private sector financing arm of Agence Française de Développement Group (AFD Group). It has been promoting sustainable economic, social and environmental development for over 40 years. Proparco provides funding and support to both businesses and financial institutions in Africa, Asia, Latin America and the Middle East. Its action focuses on the key development sectors: infrastructure, mainly for renewable energies, agribusiness, financial institutions, health and education.

Its operations aim to strengthen the contribution of private players to the achievement of the Sustainable Development Goals (SDGs) adopted by the international community in 2015. To this end, Proparco finances companies whose activity contributes to creating jobs and decent incomes, providing essential goods and services and combating climate change. For a World in Common.

For further information: www.proparco.fr and @Proparco

About Capital Bank Group

Capital Bank Group is considered one of the top financial institutions operating in the Jordanian and regional markets, with assets of JOD 4 billion, while the total equity of its shareholders is approximately JOD 400 million.

Capital Bank Group includes; Capital Bank, which since its inception in 1995, has grown to become one of the top financial institutions in Jordan, offering the Jordanian market a comprehensive set of commercial and investment banking services and solutions tailored to the needs of retail and corporate clients alike.

Established in 1995 as a corporate bank with a focus on export and trade finance, Capital Bank of Jordan (CBoJ) has operated a strategic reorientation towards SME financing and a good client proximity through digital channels and well-designed digital products and services. With its strong commitment towards the SME sector and an elaborated set of products and services, the bank aims to become the leading SME bank in the country.

In 2005, Capital Bank (Jordan) purchased majority shares of the National Bank of Iraq (61.85%), which enabled NBI to develop its products and services, strengthen its foothold and enhance financial inclusion at the country level, support export activities and provide all services to Jordanian companies operating In Iraq. As for Capital Investments, it is a wholly owned subsidiary of Capital Bank established in 2006, and offers specialized investment banking services to its clients through its offices in Jordan and the United Arab Emirates / Dubai International Financial Center (DIFC).

Before the end of 2020, in a bid to accomplish its expansion plans, Capital Bank Group took the full acquisition of Lebanese Bank Audi business in Jordan and Iraq.

Learn more: www.capitalbank.jo

Further reading

Proparco and DEG support Capital Bank of Jordan in its SMEs lending activites with loan up to $75m

Capital Bank, Proparco and DEG partner up to support SMEs in Jordan: the loan provided by Proparco and its German counterpart DEG will finance the SME portfolio of Capital Bank, ranking fourth among J...

Published on october 11 2021