News

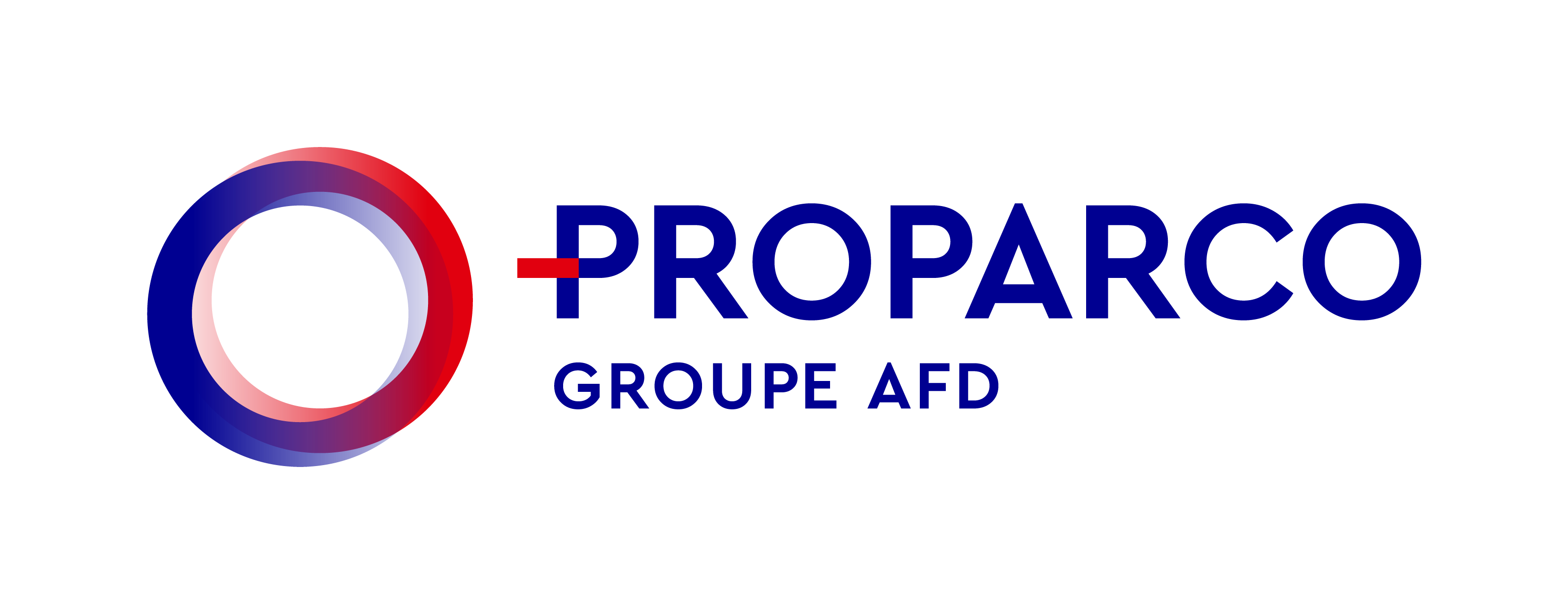

Rebuilding a Shattered Nation: The Impact of Wireless Communication and Mobile Banking in Afghanistan

In an extremely difficult context – that of Afghanistan at war – mobile phones provide users with some basic services that are essential for the country's reconstruction. The explosion in the developm...

Published on

The Impacts of the Mobile Phone Sector on Development: Mixed Results?

The expansion of the mobile phone sector in developing countries would appear to have obvious benefits. However, the conditions in which this takes place can sometimes be questioned. Deregulation in t...

Published on

How to Succeed in Developing Countries for a Mobile Telephony Operator? The Case of Milicom

Some mobile phone operators invested in developing countries very early on, whereas profitability seemed to be uncertain. If such investments are to be profitable, it is necessary to respect some key...

Published on

Mobile Phones, Markets and Firms in Sub-Saharan Africa

In Sub-Saharan Africa, the use of mobile phones has positive impacts on the way local consumer goods markets operate. Indeed, a study conducted in Niger shows that mobile phones help reduce costs and...

Published on

Mobile Telephony: A Transformational Tool for Growth and Development

The past 15 years have brought an unprecedented increase in access to telephone services in developing countries. This growth has been driven primarily by wireless technologies. Mobile phones have mad...

Published on

The African Mobile Phone Market: Beyond the Boom Phase, Between the Promise and Uncertainty of Maturity

The growth of African mobile markets over the past decade has been dramatic and well documented. Its impact has been far-reaching, directly through large capital investments and the emergence of large...

Published on

Microfinance: on the road to responsible finance?

Although serious abuses may be in the minority, the microfinance sector is not without flaws – or temptations. Some highly competitive markets put considerable pressure on costs to the detriment of se...

Published on

How can a MFI manage to have a commercial status and still target “vulnerable” people as a core client group?

When loans are extended to “vulnerable” people, too many of them are left overindebted – this could lead to a highly risky credit crisis. If microfinance institutions need to develop into fully-fledge...

Published on

Microfinance, an opportunity for socially responsible investment

Microfinance used to be seen as a simple development tool, but now provides private investors with attractive investment opportunities. It creates social benefits by helping to democratize access to f...

Published on

The role of development finance institutions in good governance for microfinance

Development finance institutions, via their involvement in the sector, give microfinance greater access to private financing. They also play a decisive role in the governance of microfinance instituti...

Published on

Striking a balance between affordable rates and satisfactory profitability in microfinance institutions

The interest rates charged by microfinance institutions (MFIs) are calculated on the basis of their financial situations and profitability targets. To make these rates more affordable for their low in...

Published on

Managing the social performance of microfinance institutions

Microfinance is booming. Beyond financial performance, it is essential for the sector not to lose sight of its social objective. The most innovative MFIs are reacting quickly to the first cases of abu...

Published on

Recent developments in the impact and mechanisms of microfinance

Microfinance has aroused widespread enthusiasm over the past 20 years. Its specific credit methodology (group solidarity, small loans, etc…) was thought to solve a number of informational problems on...

Published on

What resources to finance the development of the microfinance sector?

Microfinance is booming and requires considerable additional funds. The equity of microfinance institutions (MFIs) needs to be strengthened; private investors – that invest when certain conditions are...

Published on

Microfinance and non-financial services: an impossible marriage?

Microfinance institutions (MFIs) can - in addition to their classic products - develop non-financial services: vocational training, technical assistance, agricultural or health education. The comparat...

Published on

Beyond PPPs: the World Economic Forum Water Initiative, a Multi-stakeholder Approach

The World Economic Forum’s public-private water initiative in South Africa and India showed that “Brokerage Networks”, involving stakeholders across all sectors, proved successful in conceptualising,...

Published on

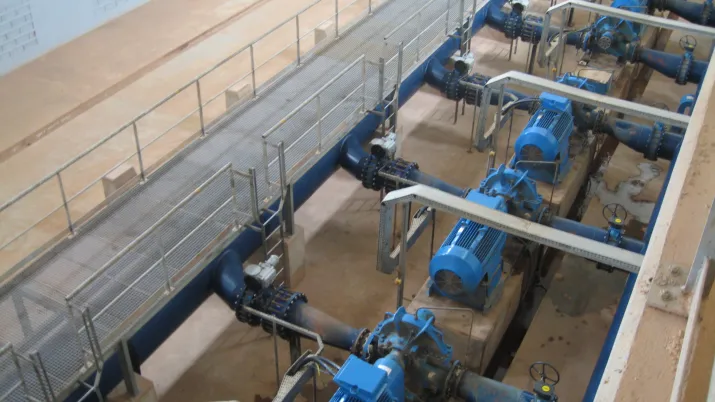

A New Generation of Public-Private Partnerships for Drinking Water and Sanitation in Developing Countries

There is a gradually rising trend in developing countries towards more professionally managed urban drinking water services as a result of delegation to private companies. The integration of a new gen...

Published on

How to Develop Access to Water for the Most Disadvantaged Populations?

Veolia designs and implements specific programs for access to water, sanitation and electricity services for all. Water tariff policies are core to the success of programs to develop access to essenti...

Published on

The Interest of Multiplayer Dialogue for Public Service Operators

IGD has designed the concept of Quadrilogues – four-party dialogues – based on the observation that the success of public-private partnerships depends on the various stakeholders' capacity to dialogue...

Published on

From PPPs to “4Ps”, Public-Private Partnerships Need Participative management

The various experiences of Public-Private Partnerships (PPPs) in developing countries have underscored the importance of participative management and dialogue among stakeholders. They are indeed prere...

Published on